New 2024 Withholding Tables – For 2024, the lowest rate of 10% will apply to individual with taxable income up to $11,600 and joint filers up to $23,200. The top rate of 37% will apply to individuals making above $609,350 and . Changes to tax ranges could save you money. Here’s what to know about filing for the 2024 tax year in 2025. .

New 2024 Withholding Tables

Source : www.forbes.com

Projected 2024 Income Tax Brackets CPA Practice Advisor

Source : www.cpapracticeadvisor.com

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

Kick Start Your Tax Planning For 2024

Source : www.benefitandfinancial.com

IRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.com

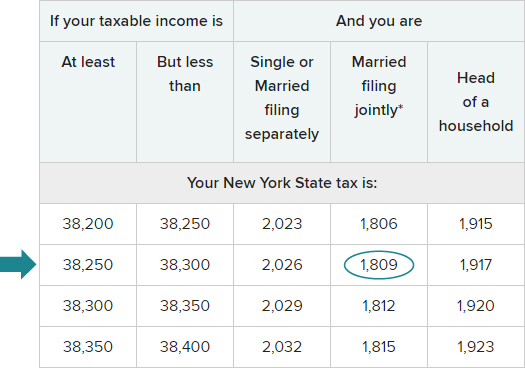

Tax tables for Form IT 201

Source : www.tax.ny.gov

IRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.com

IRS Issues Table for Calculating Premium Tax Credit for 2024 CPA

Source : www.cpapracticeadvisor.com

IRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.com

Tax rates for the 2024 year of assessment Just One Lap

Source : justonelap.com

New 2024 Withholding Tables Your First Look At 2024 Tax Rates: Projected Brackets, Standard : Since the due date for your 2023 federal income tax return is still months away, it might seem odd to start thinking about your 2024 federal tax return now. But it’s never too early to begin preparing . Axios Visuals The Internal Revenue Service released its annual inflation adjustments Thursday for the 2024 tax year that will boost paychecks and lower income tax for many Americans. Why it matters: .